Should you worry when markets are at all time highs?

It's a common concern, seeing the market climb higher and higher. Often combined with a feeling that you really should have invested a few months ago but you put it off. Why would you feel comfortable investing when the market has just pushed past all time highs? As any good investor knows - the value you receive is directly related to the price you pay so surely the price has been steadily decreasing now for months? It's no wonder when faced with what can seem and feel quite a scary market to want to hold back a bit. If you're being entirely honest with yourself, this is why you didn't invest a few months ago.

More importantly, are you now choosing the very worst time to consider investing? Is this the next September 2002, September 2008 or perhaps March 2020 moment? The day you have chosen is just before the biggest crash in the generation - typical my luck.

Does an 'expensive' market always revert to mean?

So let's examine the case for this. If these thoughts are valid then perhaps we can see in the data that the market. Below is from Dimensional:

EXHIBIT 1

Average Annualized Returns After New Market Highs

S&P 500, January 1926-December 2018

Past performance is not a reliable guide to future returns or some other tedious risk warning. There were 1,115 observation months in the sample. January 1990–Present: S&P 500 Total Returns Index. S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global.

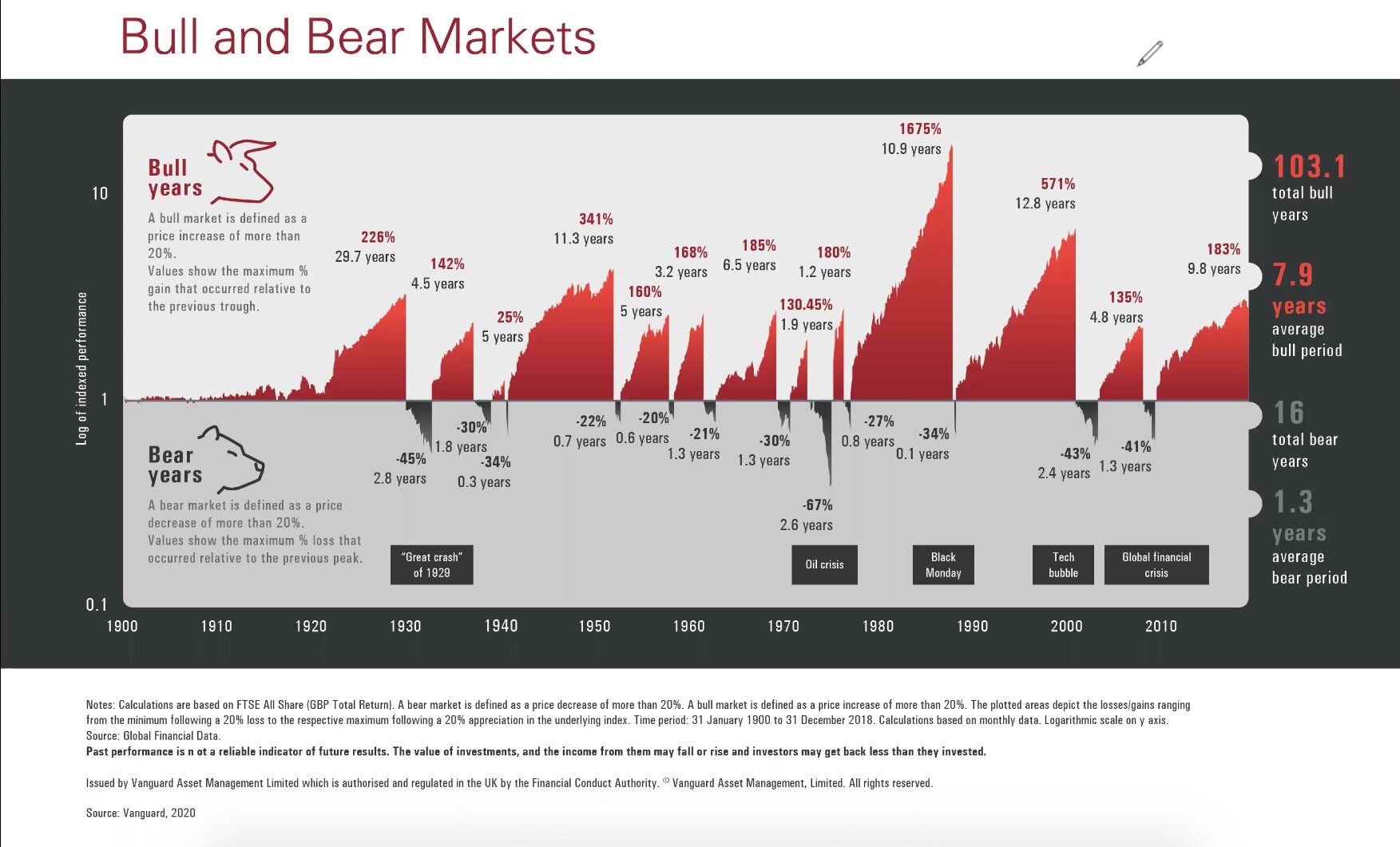

The answer to this is quite intuitive when you think about it. What is expensive? Can we accurately define it? Is the market expensive compared to the past or is it cheap compared the future? History would teach us the latter is more accurate, while past performance doesn't reflect the future, it's all we've got to use as a guide. As you can see below with this in mind, the periods of forward march are considerably longer than the reversals.

One problem - split two ways

There is also a less appreciated issue that you also need to consider here. Assuming you initially wanted to be in the market as you wish to grow your wealth and that remains your goal. If you come out of the market you better have a very specific framework for getting back in as the initial question of:

"The markets are at an all time high, is now a good time to invest??"

Will be followed by the less attractive sibling:

"Is it a good idea to invest when the markets falling??"

The point is, if you do want to achieve the results of multi-decade investing. The concept that sitting on the sidelines is somehow a 'stress-free' approach is a bit inaccurate. It's better to reframe the problem as one where you remove volatility but you introduce concerns of inertia and 'Fear Of Missing Out '(FOMO). As the below shows, we don't know the market surges or pullbacks will happen but the impact of losing those days in the market can have a profound effects on your long term returns:

I do want to be academically accurate though with this and if you miss the worst days this can greatly increase returns as-well. Good luck with that crystal ball though!

"The stock market is a device from transferring money from the impatient to the patient." - Warren Buffet

The thing to remember is that when you take part in a diversified group of the companies of the world. You are buying into to their future productive capacity and a bet against this globally is a bet against the human race continuing to invent, produce, innovate and advance

The truth is no investor, no adviser and certainly no market commentator knows the exact point when markets will pull back or push forward. There are no guarantees in this life with investing but if you can recognise the reason you get a positive return is that you are willing to sit out some ups and down and you build a solid enough financial plan that will enable you to do so. You can understand there is one thing the history of the markets tell us - timing is not everything.

Investment involves risks. The investment return and principal value of an investment may fluctuate so that an investor's portfolio, when redeemed, may be worth more or less than their original value. Past performance is no guarantee of future results.

The information provided in this presentation has been compiled from sources believed to be reliable and current, but accuracy should be placed in the context of the underlying assumptions.

All videos are being provided for informational purposes only and should not be considered to be investment or tax advice. No investment decisions should be made solely based on the information in any of these videos or blog posts.