The Problem With -"I’ll buy back when things improve”

Photo by Wesley Tingey on Unsplash

"It's not that any of these things are bad or wrong. It's that knowing what to do tells you nothing about what happens in your head when you try and do it."

Morgan Housel - The Psychology of Money

12th March 2020

The global markets experience their fastest drop in history. Around 30% in most G20 countries as leaders around the world grappled with the challenges of a global pandemic not seen for over a century. The developed economies facing an unprecedented supply shock not seen since WW2 and the future for both lives and livelihood aroundis the world looking deeply uncertain.

Even jobs that had been secure for years, if not decades were now at risk. Trying to navigate your way through 'the new normal.' You are bombarded daily by breaking news, notifications, daily briefings and scramble to try and try and come to terms with how you and your family can now shop safely which you try and comprehend how the next few months will be in government-imposed isolation...

Too soon for flashbacks....? Well, for the purposes of this post, I want you to think about how you felt at that point and if you had them, how you felt about your investments.

It is all too easy to summarise that all market declines are part and parcel of capturing investment growth over the long run and there will be periods of uncertainty and downturns, sometimes extended, sometimes short. The key is we won't know when and we won't know for exactly how long. As a very broad statement and history being our guide. The market spends roughly 75%/80% of the time in advance and 25%/20% in decline:

Faced with such uncertainty during the “25%” of the time. Surely the most rational thing to do would be to suspend any investments to avoid the impending further declines and wait on the sidelines, in safer waters, until the market calms down? You can capture the upside... It sounds deeply intuitive.

9th March 2009

The official bottom of the stock market (the US market, the FTSE lagged this slightly) after one of the worst drops since The Great Depression. Things for all observers would have looked pretty bleak just as they did recently. Here are some newspaper headlines from that day:

Source - Daily Mail - 9th March 2009

Source - Daily Express - 9th March 2009

While no recession is the same. They do have the same characteristics and in the midst of a bear market, the headlines generally are very bleak. This provides a negative feedback loop and like being stuck in the storm, it's difficult to see your way out.

The thing you would however have missed on that day in this frenzy of negative headlines was the fact that this was the official bottom of the market (at least the US market) and that this for a 'market timer' would have been one of the best opportunity in recent history to invest. The S&P since then had delivered a 10-year annualised total return of 17.8 percent since its financial crisis bottom in March 2009, matching the annual gains 10 years after the 1987 crash and the August 1982 bottom

I think it's important to take a step back for a second. How would it have felt not buying into the constant stream of information about 'how things would get worse’ that the market would continue to fall? Do you feel you would have been able to stay true to the plan and been unaffected by the narrative being thrown upon them by the media on a daily basis? This is a time when working with the right planner who really cares about your and your family’s financial future can pay off enormously.

So what is happening here and why is there such as disconnect. Surely things from that exact point would have started to improve.?

Well no actually, the consensus didn't start to improve for some time. Due to a mixture of the delayed impact and austerity. For the 'media following investor' things continued to look dark for some time. To understand the disconnect from the news and market you have to understand:

The market and the economy

A fair question would be. When the market is pricing in the economic data and all the companies’ valuations are a product of the future cash flow they can achieve which is affected by the economy. How can the valuations rise at all factoring in the endless stream of bleak economic data and forecasts??

The answer is:

THE STOCK MARKET IS FORWARD-LOOKING

ECONOMIC DATA IS BACKWARDS LOOKING

Economic data lags the market considerably, often up to a year. We don't know we are in a recession until by definition 2 quarters after it has officially started. However, the market prices are in future expectations. A share price is the discounted value of future cash flows. It is the future it is focusing on so the market often does not change due to bad news, only if the bad news is worse than what was already priced in.

This is why you can see things like this....

Source - CNBC

The speed of the decline can often be matched by the speed of the recovery

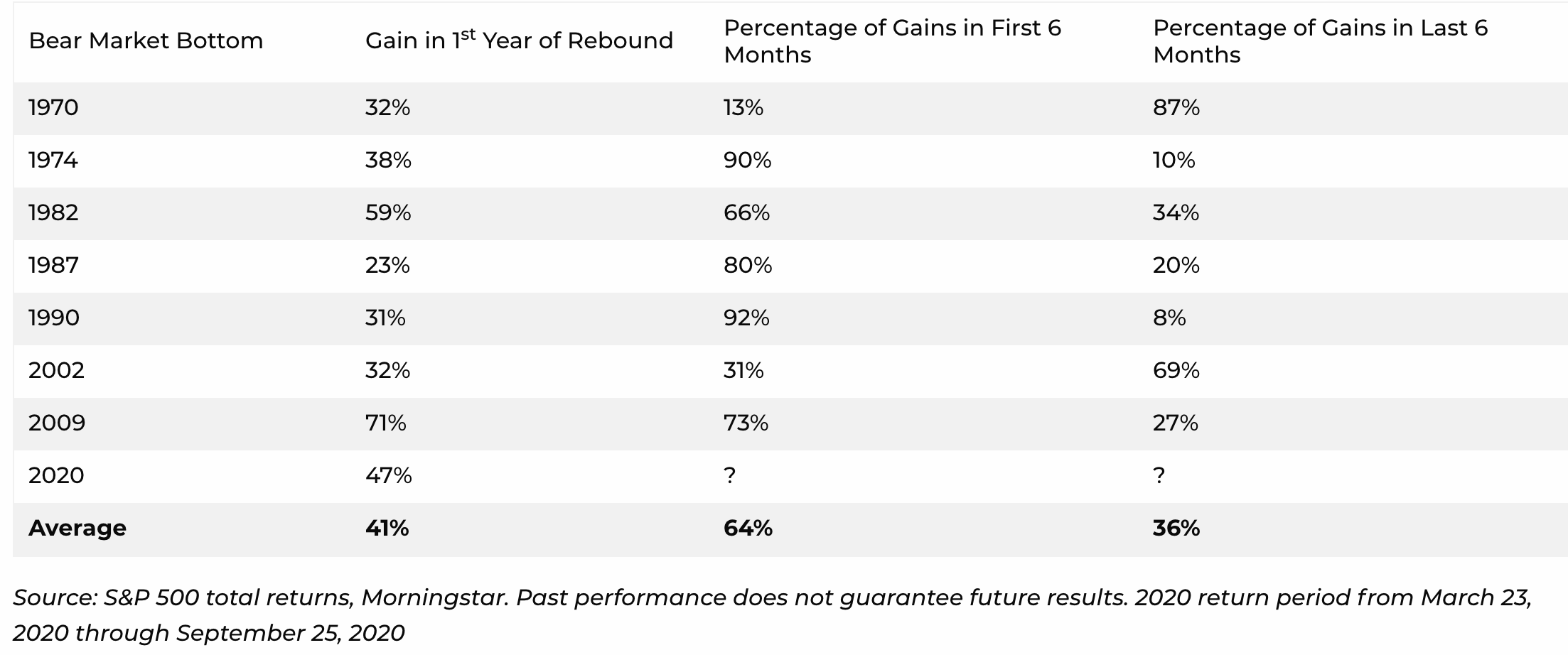

This is not intended to be an overly positive spin on the 'pro-investing' view. Only a reflection on the data. While every bear market will be different. As you can see below, from a historical perspective the speed of the recovery can also be fast. This means that if you were in cash on the sidelines waiting for things to improve. You are playing a very dangerous game. Especially if you initially had decided to take any funds out because the market has dropped.

The 'beast of market timing' has many faces

The harder task sometimes is that the 'beast of market timing' has many faces. A lot of them appear rational depending on your environment. It wouldn't be unexpected for someone who normally avoids an approach of market timing also be an advocate for holding off investing after seeing a 20/30% drop in the market.

No spreadsheet can recreate the very real feeling of uncertainty. However, the problem with 'I'll buy back when things improve' is assuming that you want to invest. You have potentially removed one problem but you've now created many more. The same could be said of any market timing strategy. Our initial problem was the concern about future declines. You now have some more problems:

When to get back in

When things 'feel more certain' at that point (spoiler alert, the market never feels certain because it isn't)

The losses you may incur by not staying invested.

The problem with intuition as Nobel Prize winner Daniel Kahneman writes in his seminal book 'Thinking Fast and Slow' is that intuition is generally a very poor guide for decision making. Building a strategy around something which is so hard defined and let alone rely on often doesn’t lend itself to consistent results.

In my view, the better way to think about it is not to pretend to be a complete robot and unconcerned over market declines. They tend to coincide with great periods of uncertainty. To ignore our natural fight or flight response in this time is to ignore what makes us human. Instead, re-frame the situation. Market declines are a completely natural by-product of positive investment returns. They are the price of admission for investing and achieving growth. You are paid for the uncertainty so shouldn’t be surprised when there is a change to investor expectations. However, history being our guide, a well-diversified portfolio of global equities to date has always recovered and gone on to provide positive returns. What you tapped into before a drop is the same thing you are tapped into now. The future ingenuity and progress of the best leaders in the world, while challenges are common and to be expected. The collective will and brainpower of our global society figures it out and finds a way to progress.

There is a reason why professional investors say 'it's time in the market, not timing the market that counts.'

AND HERE'S A LOAD OF JARRING DISCLOSURE REQUIREMENTS....

Investment involves risks. The investment return and principal value of an investment may fluctuate so that an investor's portfolio, when redeemed, may be worth more or less than its original value. Past performance is no guarantee of future results.

The information provided in this article has been compiled from sources believed to be reliable and current, but accuracy should be placed in the context of the underlying assumptions.

All videos and articles are being provided for informational purposes only and should not be considered to be investment or tax advice. No investment decisions should be made solely based on the information in any of these videos or blog posts.

Header photo by Wesley Tingey on Unsplash - free of copyright but can be removed upon request.