Why you should want to own the world

Isn’t it strange that we develop an emotional connection to that which is familiar? Walk down the street and you see brands and household names which have been around since you were a child. If the business is one which you've known for years and often had interaction with. It somehow feels more secure.

This is a well known bias called 'familiarity bias.' It's worth taking a step back and asking the question. Why exactly on the macro level would the businesses in the UK be more profitable than those in Norway? In this article I am going to be putting forward the case for going global - why you should want to own the world.

The Rise and Fall of Empires

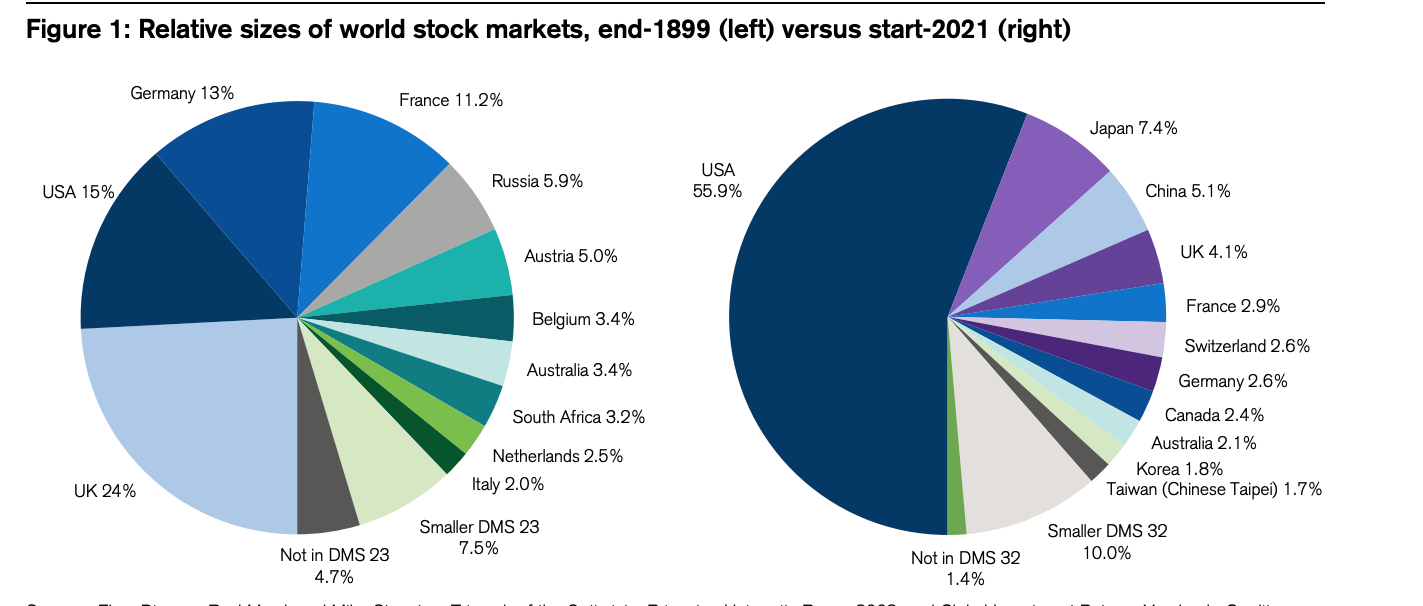

Ok, perhaps a tad grandiose but the reality is there is a constant change to the world's supply chain. The stock markets for each country and the return that comes with it changes on a year by year basis. With certain countries inevitably having their day in sun like Japan in the late 80's. The problem is we don't know who will be tomorrow's victors and trying to guess this can cost you severely if you're wrong.

The US market has had an incredible run for the best part of half a century but it’s important not to extrapolate future returns based purely on the past. With emerging markets, the truth is it's very difficult to know without hindsight which country can navigate the journey from growing population to growing capital market.

For example, look at the below which Illustrates just how much the global stock markets have changed since 1899.

Source - Dimson, Marsh and Staunton - Credit Suisse Global Returns Yearbook

Home Bias

Most portfolios have an element of home bias which is the country the investor is from will have a higher allocation than you would expect if it was purely a neutral allocation. Such arguments often fall around managing inflation so that earnings are linked to the home currency.

One of key rebuttals to this argument with the FTSE 100 is to note that the UK's big companies actually draw the majority of their earnings overseas. This is partly true but it still doesn't solve the other issues that comes hand in hand with this another impact of home bias which is....

Sector Bias

If you want a simple answer for one of the large disparities between US and UK performance after the pandemic, look at ‘sector bias.’ The FTSE 100 has a limited number of tech companies which had been the main financial beneficiaries of the pandemic. As at June 2020, financials made up 17.7% and energy around 10% and these sectors are pretty much the poster boy of 'what going to get hammered in a pandemic.'

Although if you do want to look at a proper bit of sector bias then look no further than JP Morgan's analysis of Brazil's at almost 40% financials:

Reducing Risk

There is another key benefit which is a well diversified portfolio of international equities - it reduce risk. In the paper from Vanguard 'Global Equity Investing: The benefit of diversification and sizing your allocation' they found that bringing in international diversification in most markets substantially reduces volatility. Now I'm not saying we should be defining risk are just volatility but that's how academic finance works so there you go:

It's not all good news though. Consideration has to be given to the sting in the tail of the globally diversified investor which is - currency risk.

Whether to 'hedge' a portfolio against international currency risk is a complex topic. It's very much a case of 'pick your poison' trying to manage this with a very real risk of being dammed if you do and dammed if you don't with any positioning often being reduced to a currency bet. You have to not only be aware of the currency but also the interest rate differential between local rates and the rate of your investor's currency. It's important to remember that a currency itself offers zero value. There is no coupon and no dividend for a currency therefore in the long run currency risk tends to be reflected in volatility more than anything. In-fact even some evidence that a hedged portfolio can cause spikes in volatility.

The take home?

Most portfolios will have some level home bias and whether that's needed or not is something you could debate until the cows..... ehem.

The main thing as investor is to make sure your portfolio is setup right. A mistake on over-concentrating geographically could potentially be the difference between substantial long-term returns. The opposite of course is true - if you hit the jackpot and pick the right country.

Ultimately what it comes down to is risk management and making sure you are stacking the odds in your favour instead of trying to pick the next big winner. After all, as rat tail says....