Predictions are hard… especially about the future

“An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.”– Laurence J. Peter

The financial services world thrives on making you feel they know something you don’t. While it's important to pay some respects to what is undoubtedly well educated, researched and relevant information. Carl Richards who is a US adviser and client communication specialist talks about the importance when he takes on a new client of doing a 'detox from financial pornography.' In a world where most of us now spend a lot of our waking hours glued to our screens. Our newsfeeds become our reality and there are few areas where the interests of the long-term investors are quite as heavily mismatched as with listening to financial forecasts.

Fortune tellers are considered the world’s second-oldest profession. With records spanning back over 5,000 years to the ancient art of divination, attempting to tell the future through seeing patterns in everything. The concept of an ‘Oracle’ is one that spans from ancient cultures to modern pop culture. It is only human to seek guidance and to want to maintain a semblance of control.

How good are the experts?

The truth is, there is only one thing that forecasters seem to be able to consistently deliver in the world of financial markets..... bad predictions.

A paper in 2021 called ‘Analyst Forecast and Currency Markets’ setup to research analyst forecast in currency markets from 2006 to 2020. The results were:

The analysts performed worse than a random walk (modelling with random selection).

Forecast performance from globally systemically important banks did not differ from non-systematically important banks. (It doesn’t matter how big or well funded you are, your predictions are still poor).

The analysts were negatively related to excess returns. (You could have inverted the analyst's forecasts and done ok)

In the book, ‘The Fortune Sellers’ William Sherden researched the multi-billion dollar industry that practices the world’s second oldest profession. From The Council of Economic Advisors, The National Weather Service to the Tabloids. In the book, Sherden reviewed the leading research at the time on forecasting accuracy from 1970 to 1995. He found:

Economists’ forecasting skill is about as good as guessing. For example, even the economists who directly or indirectly run the economy — the Federal Reserve, the Council of Economic Advisors and the Congressional Budget — had forecasting records that were worse than pure chance.

The more sophisticated and higher budget the forecasters had, did not improve the quality of the forecasts.

Economists weren’t able to predict turning points in the economy. Of the 48 predictions that were made, 46 of them missed the turning points.

2020 Vision

We don’t have to look far back to see the real-time version of predictions missing the mark and if there was ever a year to be reminded of this, it was 2020. Here are some of the time:

JP Morgan was predicting 2.5% and that consumer demand will remain the backbone of growth in 2020

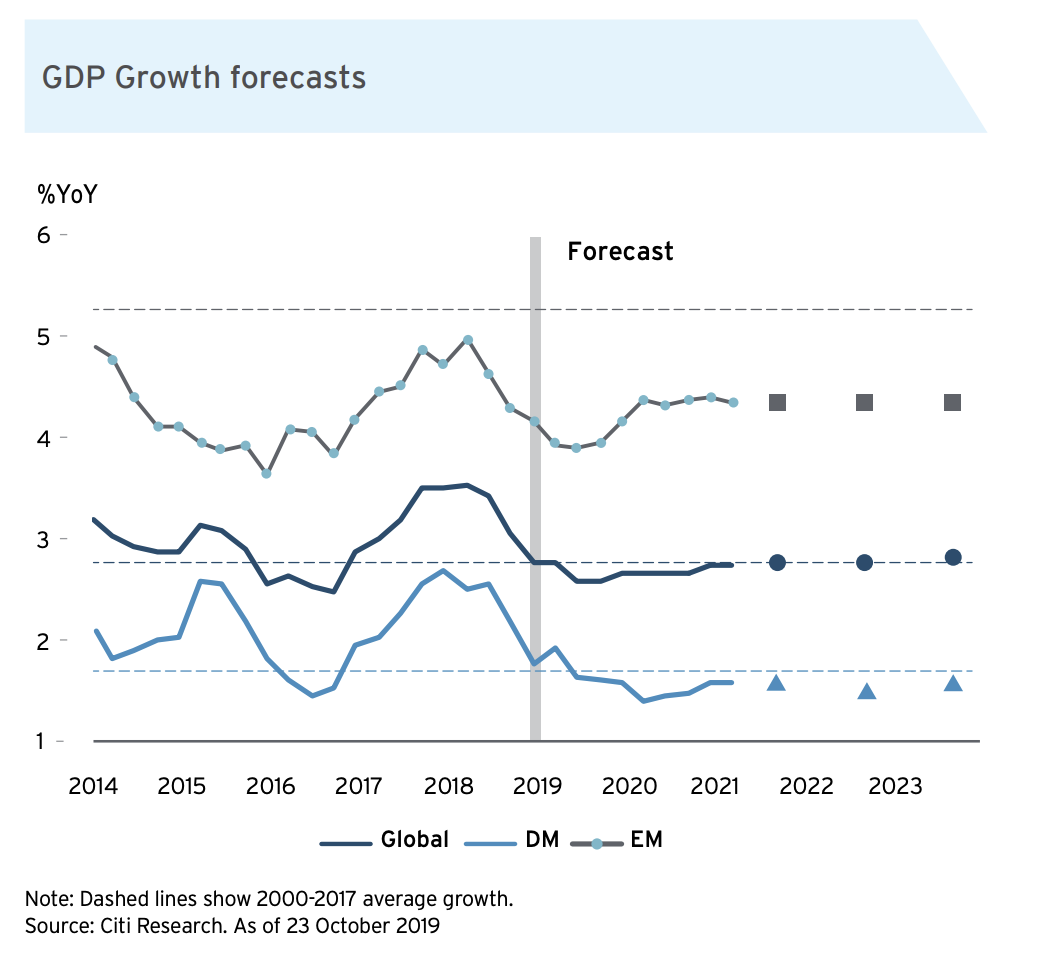

Citibank showed slowing but steady growth:

What actually happened….

Well, you know the rest. We entered the most aggressive drop in GDP since records began in 1948:

The investment is just the fuel

Without even touching upon the fact that the economy is not the same as the stock market as I do here. The purpose of this reminder is just to clarify where the real focus should lie. Your financial plan should be at the heart of why you make decisions. This, in short, is a clear plan of how you achieve the life you want (whatever that is) factoring in the key risks:

Inflation will halve the value of cash over 20 to 25 years

Your most valuable asset is your time.

All planning is just the process of defining and implementing how your capital (your money) and your values so they can support each other.

Nobody and I mean nobody, is exempt from life’s misfortunes.

If we can take a step back and recognise this is why we have investments and ensure we account for the ups and downs along the way, it’s clear to understand that spending your valuable time focusing on short or medium-term forecasts is not in your interests. We must build into the plan the uncertainty but we cannot beholden to it.

How to frame the investment volatility

I’ve mentioned in previous videos the concept of the ‘risk premium.’ This is a crucial term to be aware of. As investors, you are paid for risk (uncertainty). If there was no level of uncertainty which is defined as the ups and downs along the way, then your investments would not generate a positive return over the long term. After all, if it was possible for everyone to make money in a risk-free way they would then leverage/borrow/gear up that trade to an exponential level to profit from it. The reason they are limited in doing so is there are some undiversifiable risks.

If you did not experience the ups and downs along the way you, would not get positive returns.

You don’t need to be right, right now

The point of this isn't to disparage what is often very well researched and logical forecasts. Anyone can be wrong with a prediction but if you are sitting down with a financial adviser/planner. Listen carefully to what they say they don't know and how they can manage this. You want to hear how much they focus on uncertainty and how they plan to manage it. If they are putting too much emphasis onto the false promises of knowing which way the world is heading, be wary.

Stick to what has always worked for the last hundred years. Having sufficient cash to sit out emergencies and the inevitable temporary declines, protect your ability to earn, invest in a diverse mix of real companies buying and selling things to real people. Then give your funds sufficient time to grow. (I tried to find an MSCI World version of this as I appreciate choosing the US market along is being selective).

The secret is to put yourself in a position where instead of focusing on the endless deluge of market movements. You can focus on the purpose of the plan. If your planner has worked with you to align your capital to your values this should be obvious. You will then appreciate how the day to day movements of a chaotic market are totally irrelevant. They are a byproduct of the long-term return. When we project forward about the uncertainty we tend to discount the reality that we have a capacity to be resourceful and adapt. If there is one fact that will be missing from all these outlooks it is this. Once you have done that. You then have the power to not only frame market movements in the context of their insignificance but also understand we don’t need to know the future to accomplish our financial goals.